The Best Practices and Benefits of Trading with a Regulated Exness Broker

In the vast and dynamic world of Forex trading, choosing the right broker is fundamental to your success. One name that stands out among the crowd is Regulated Exness Broker regulated Exness broker. This article explores the significance of regulation in the Forex industry, particularly focusing on how Exness adheres to industry standards to provide a secure trading environment for its clients.

Understanding Forex Regulation

Forex regulation refers to the oversight by government agencies that enforce compliance within the trading sector. Regulated brokers are those who operate under the guidance of regulatory authorities, which ensures that they follow strict financial and ethical guidelines. This regulation serves to protect traders from fraudulent activities and financial mismanagement.

Why Choose a Regulated Broker?

Opting for a regulated broker such as Exness offers numerous advantages:

- Investor Protection: Regulated brokers are required to maintain certain safeguards, including segregated accounts, which keep client funds separate from the broker’s operational funds. This means that in the unlikely event of bankruptcy, clients’ funds remain protected.

- Transparency: A regulated Exness broker is mandated to provide transparent information regarding fees, trading conditions, and execution policies. This transparency enables traders to make informed decisions.

- Dispute Resolution: If any disputes arise between the trader and the broker, regulated entities follow proper channels for resolution, which can offer peace of mind to those participating in Forex trading.

Exness: A Brief Overview

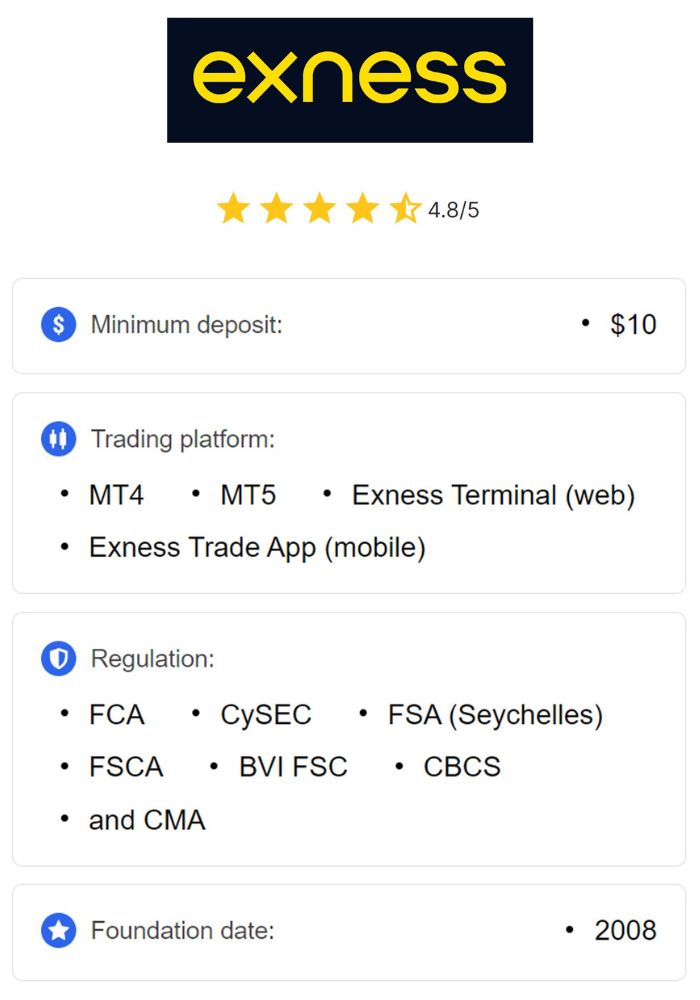

Founded in 2008, Exness has grown into one of the world’s leading online Forex brokers, thanks to its commitment to regulatory compliance and customer service. The broker operates under multiple regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Key Features of Regulated Exness Broker

Variety of Account Types

Exness offers various account types catering to different trader profiles, from beginners to seasoned professionals. These accounts come with different features and minimum deposit requirements, allowing traders to select an option that aligns with their trading strategy and financial goals.

Low Trading Costs

One of the distinguishing factors of Exness is the low trading costs. The broker provides competitive spreads and commissions, enabling traders to maximize their profits. This cost-effectiveness is particularly advantageous for high-frequency traders who require low spreads to be successful.

Wide Range of Trading Instruments

Traders can access a diverse range of financial instruments through Exness, including major and minor currency pairs, commodities, indices, stocks, and cryptocurrencies. This extensive selection allows traders to diversify their portfolios and manage risks effectively.

Advanced Trading Platforms

Exness provides robust trading platforms, including the widely-used MetaTrader 4 and MetaTrader 5. These platforms offer powerful tools for technical analysis, automation of trading strategies, and a user-friendly interface that caters to traders at all experience levels.

Excellent Customer Support

A regulated Exness broker places significant emphasis on customer service. With a multilingual support team available 24/7 through various channels, traders can receive assistance whenever they encounter issues or have questions regarding their accounts.

Educational Resources

To empower its clients, Exness offers a wealth of educational resources, including webinars, trading tutorials, and market analysis. These tools help traders enhance their skills and stay informed about market trends, leading to more informed trading decisions.

The Importance of Regulation in Forex Trading

Regulation serves as a cornerstone of trust in the Forex market. Traders engaging with regulated brokers like Exness can feel confident that their funds are secure and that they are participating in a fair trading environment. Regulatory bodies regularly audit their licensed brokers, ensuring ongoing compliance with financial regulations. This supervision helps to mitigate risks associated with trading, contributing to a more stable trading ecosystem.

Risks of Trading with Unregulated Brokers

While the allure of higher leverage and lower fees can be tempting, trading with unregulated brokers carries inherent risks:

- Increased Risk of Fraud: Unregulated brokers may engage in misleading practices, leaving traders vulnerable to scams. Without any regulatory oversight, there is little recourse for those who fall victim to fraudulent activities.

- Lack of Transparency: Unregulated brokers are often not required to publish their financial status or operational policies, leading to obscurity about their trading conditions.

- No Investor Protection: Traders with unregulated brokers have little to no protection for their investments, which increases the risk of significant financial loss.

Conclusion

Choosing to trade with a regulated Exness broker can be a significant deciding factor in your trading success. With its strong regulatory framework, competitive trading conditions, and committed customer support, Exness provides a safe and transparent environment for traders worldwide. Understanding the importance of regulation in the Forex market can help traders navigate their options and make informed decisions that align with their financial goals. Ultimately, choosing a trusted, regulated broker is not just wise—it’s essential for long-term success in trading.